- Home /

- Types of Annuities/

- Charitable Remainder Annuity Trust

Charitable Remainder Annuity Trust

Leave a Guaranteed Legacy

Leave a Guaranteed Legacy

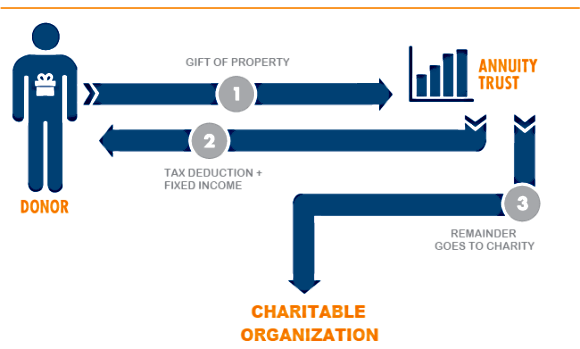

A charitable remainder annuity trust, or CRAT, is a trust that is established to provide annual disbursements to a beneficiary.

In most situations, the trust is initially funded with a mix of assets such as cash, bonds, stocks, and other securities.

This type of life income plan normally specifies a specific dollar amount that may be disbursed in each twelve month period

and usually has to be at least five percent of current value of the trust.

It is possible to set up a charitable remainder annuity trust as a way to plan for the retirement years. For example, the donor transfers a variety of assets into the trust. Each year, a fixed payment is issued to the donor. Upon the death of the donor, any assets remaining in the trust are transferred to a charity previously designated by the donor.

The charitable remainder annuity trust can be structured to allow all assets placed in the trust to generate annual income for a specified beneficiary even before the death of the donor. Instead of the fixed annual disbursement going to the donor, that payment is forwarded to the designated charity. The annual contributions to the charity continue for as long as the donor remains alive. After the donor passes away, the remainder of the trust is transferred to the charity.

In order for a charitable remainder annuity trust to function within the regulations established in most countries, a trustee must administer the trust. In some instances, the trustee can be the charity that will ultimately receive the full benefit from the trust. Other locations require that the trustee be a third party who can remain neutral. For example, an attorney, a financial institution such as a bank, or a financial consultant may function as the trustee.

One of the benefits of the charitable remainder annuity trust is that the value of the trust can be used as a deduction

on the annual income tax return. This can help the donor to manage his or her tax burden with more efficiency. For the

recipient of the real property and other assets included in the trust, the annual disbursement helps to provide a degree

of financial stability as well as helping to assure a limited amount of security for the future.

Once a charitable remainder annuity trust is established, the donor still has the option of amending or revoking the trust. However, depending on current laws and regulations that impact the function of trusts in the country where the CRAT is established, there may be some financial penalties involved in making any changes to the structure